|

Financial Management

27 November 2013

The development and use of

budgets, proper costing and pricing strategies, standard accounting practices,

and asset and cash flow management to achieve the financial goals of the event

enterprise.

After reading this article you

should understand how to

-

recognize and use

standard accounting practices, procedures, and terminology in order to

collaborate with financial personnel and institutions

-

develop, adhere

to, and monitor income and expense budgets through proper allocation,

calculations, forecasting, and cost controls in order to meet the profitability

objectives of an event project

-

determine

accurate cost estimates, pricing procedures, and profit expectations in order to

establish appropriate fees, prices, and bid quotations

-

establish

appropriate financial controls and procedures in order to monitor and maintain

adequate cash flow to meet the disbursement needs for an event project

-

prepare and

interpret financial records and reports and establish the proper reporting

procedures in order to ensure compliance with statutory and fiduciary

requirements

|

Major Functions |

Performance Elements |

|

Accounting |

Understand the terminology

Understand the system

Collaborate with financial personnel to maintain the system |

|

Budget Management |

Determine profit objectives

Forecast costs and revenues

Allocate financial resources according to priorities

Track budget performance |

|

Pricing |

Calculate direct and indirect costs

Determine profit requirements

Establish pricing structure |

|

Cash Management |

Establish payment policies and procedures

Develop cost controls

Manage cash flow

Implement cash handling procedures |

|

Reporting |

Establish reporting system

Interpret financial information

Prepare financial reports

Maintain financial records |

Money is a resource critical to

event projects and event organizations; without it events would not take place.

It comes in from those who host, support, sponsor, or attend an event, and it

goes out to pay for all the goods, services, and staffing needed to make it

happen. Whether an event project is a small private social event or a large

public community event, it is almost always someone else’s money that is

being spent. This means that the money must be spent wisely. It also means that

specific records must be kept to verify how the money was spent and why.

Financial management is the

handling of the money related to the event project, and the strategies to

maximize the acquisition and use of that money. Effective financial management

relies on an interrelated system of acquiring, allocating, and accounting for

the financial resources of an event project. Each facet–accounting, budgeting,

pricing, cash handling, and reporting–influences and is shaped by every other

facet.

-

Accounting simply

refers to the approach set up to record and track how, when, where, and why

monies come in and go out of the system.

-

Budgeting refers

to the plan established for the allocation of the monies coming in and going out

of the system.

-

Pricing refers to

the calculations required to meet the budgeted revenue requirements.

-

Cash handling

refers to the procedures necessary to control how and when monies come in and go

out of the system.

-

Reporting

provides the financial information necessary to make good decisions about all of

the above.

Financial management can be

very intimidating – dealing with vast sums of money, other people’s money, lots

of numbers, lots of calculations, lots of paperwork, and lots of pressure to

meet “bottom line” expectations. That bottom line,

the figure at the bottom of a financial statement that shows whether or not the

event project made or lost money, can cause anxiety for even the most

experienced event organizer.

Effective budgeting, proper

accounting and pricing practices, plus sensible cash management procedures

allows you to anticipate income and expenses correctly, allocate financial

resources properly, and maintain the appropriate financial records. Without

understanding this integrated system practical budgets cannot be established or

implemented effectively, accurate pricing cannot be ascertained, records cannot

be properly prepared, and reasonable control of the event project’s monetary

assets will be next to impossible.

Accounting

Accounting is a system for

“counting” and “accounting for” the monies associated with an event project or

organization. The financial data about a project or business must be recorded,

categorized, summarized, interpreted, and communicated. You must be familiar

with the basic practices and terminology associated with accounting and

bookkeeping in order to be an effective

contributor to the financial decisions surrounding your event endeavors.

Understand the terminology

You must be conversant with the

terminology of financial management so you can communicate and work effectively

with the various stakeholders involved in the event project. These stakeholders

can range from vendors and members, executive committees or clients, public

officials to taxation authorities, or perhaps even the media. When money is

involved, people want to know how it was used. You need to be able to “talk the

talk” in order to “walk the walk.”

Understanding the terminology

and how these tools and techniques work will help you recognize and incorporate

cost-saving strategies throughout the event project. These standard accounting

tools are used throughout your financial management endeavors, including making

and managing budgets, calculating pricing, managing cash flow, and fulfilling

reporting obligations.

Basic Financial Management

Terminology

|

Accounts Payable and

Receivable |

What you owe (payable)

to others and what is owed to you (receivable) by others. In order to

maximize cash flow, accounts receivable should be pursued for the

earliest possible payment and accounts payable should be held for the

latest possible payment. |

|

Balance Sheet and

Income Statement |

The Balance Sheet is a

report, usually prepared annually, which shows the assets (own),

liabilities (owe), and equity (net worth—assets minus liabilities) at a

specific point in time. The Income Statement (also known as a P&L—profit

& loss) is a report that summarizes the income and expenses during a

given period of time, often used to track the performance of a budget.

The Balance Sheet shows where you are and the Income Statement shows you

how you got there. |

|

Cash and Accrual

Accounting |

Both are accounting

methods used for tax purposes. The Cash method charges revenue and

expenses against the tax period in which they occurred and the Accrual

method charges them against the tax period in which they were incurred

(regardless of when the actual income or expense occurs). The Accrual

method better reflects your fiscal obligations and expectations. |

|

Cash Flow Statement |

A report that

summarizes when income is received and when expenditures are made over a

given period of time, used to predict when and how much money must be

collected and/or reserved to cover payments that will be due. |

|

Chart of Accounts |

Numerically coded

categories used for the classification of financial transactions (income

and expenses) so they can be identified and allocated properly, in an

order parallel with financial statements. |

|

Direct and Indirect

Costs |

Direct costs are

expenses that can or should be applied to a specific event or function;

Indirect costs are those that are not attributable but are tangential to

a specific event or function. For example, an employee’s salary included

in the overhead is an indirect cost and the sales commission paid to the

salesperson that booked an event would likely be allocated as a direct

cost (selling expense) to that event. |

|

Fixed and Variable

Costs |

Fixed costs or expenses

are those that do not vary in relation to an amount or volume of

production or attendance (e.g., rent, dance band, etc.). Variable costs

or expenses are those that increase or decrease in relation to increased

or decreased attendance or usage. |

|

Gross and Net

|

Gross is the total

before deductions have been taken and net is the total after deductions

have been taken. For example, gross profit is the total profit and net

profit is the total after expenses have been deducted. Gross receipts

are the total revenues collected, which might need to be reported to tax

officials, from which deductible expenses or tax-exempt revenues are

deducted. |

|

Overhead |

The fixed and variable

operating costs of being “in business”, often referred to as G&A

(general and administrative), including such things as rent, utilities,

insurance, etc., which are factored into cash flow, pricing, and

profitability. |

Understand the system

Accounting is the design and

maintenance of the system for the recording and counting of sums of money, those

paid and those received and the value of property, and the records and reports

associated with these sums. The accounting system provides the measurement of

assets and liabilities and earnings, the assignment of costs to revenue, and the

determination of net income or net loss.

Bookkeeping is the systematic

recording of day-to-day financial transactions (revenues and expenditures) in

the accounting system. This includes the preparation and collection of the

underlying documents, the chronological

journalizing of transactions with their explanation and account code, and the

posting of these transactions into their appropriate categories in a ledger.

Typical underlying documents

used to substantiate income and expense sources and authorizations

|

Bank statements

Cancelled checks

Cash register tapes

Credit card slips

Credit card statements

Credit reports

Deposit slips |

Electronic transfer

statements

Expense reports

Invoices

Loan documents

Mileage logs

Paid bills |

Petty cash slips

Purchase orders

Receipts

Resale licenses

Sales slips

Tax exempt certificates |

Good bookkeeping practices will

be the foundation of the financial records and reports that facilitate good

financial decisions, as well as ensuring the event organization is in compliance

with regulatory and fiduciary requirements.

Collaborate with financial personnel to maintain the system

Collaborating with financial

personnel such as accountants and/or bookkeepers will be necessary to maintain

the accounting system. Although accountancy functions are usually handled by

financial professionals such as certified public or chartered accountants and/or

the organization’s financial officer(s), the event organizer is often involved

in the bookkeeping process and must confirm with the appropriate authority the

format to be used and the supporting documentation required. Synchronize the

event project’s bookkeeping system with the organization’s system to ensure

efficiency and accuracy.

The bookkeeping system

typically organizes financial data into categories, a list known as a chart of

accounts, organized in such a way that facilitates wise decision-making based on

reliable financial information. Each category will have sequentially numbered

account codes for the components or items

that make up income or expenses, and a budget will likely be organized according

to these categories.

Setting up the account codes

will likely be a function of the accounting system, often a computer bookkeeping

or spreadsheet software program, so that the code categories will be parallel to

and compatible with the financial reports and statements that are to be

generated. However, the extent of the account codes for bookkeeping might be

more complex than the standard accounting codes in order to accommodate the

varied income and expense categories associated with a specific event project.

The types of revenues possible and expenses required will depend on the type and

scope of the event project.

It is important to assign all

income and expenses to the proper account codes so that financial information is

properly captured, tracked, and analyzed. Becoming familiar with the account

codes and noting them on individual underlying documents and in the checkbook

register should be a standard practice. Diligence and attention to detail is as

important in bookkeeping as it is in any other facet of event management.

Budget Management

A budget is a detailed cash

plan that defines the acquisition, allocation, and disbursement of the financial

resources for an event according to the priorities and necessities of the event

project’s operations. A budget must be prepared based on sound fiscal

information and monitored closely to ensure the desired economic performance.

The budget is an integral part

of the event project business plan and helps shape and control the decisions

surrounding the event project. The sources of income must be properly defined

and the expenses must be carefully calculated in order for the profit

expectations to be realized.

Determine profit objectives

The bottom line requirements

for a budget (the net profit or loss) will be dictated by the profit objectives

of the event project’s host, producer, or sponsoring organization, which could

be to make a profit, break even, or operate at a deficit (a hosted event).

Although hosted events might not have revenue categories other than the host’s

investment reflected in the budget, they will have limits on the financial

resources that can be allocated to the event project.

Various techniques can be used

to analyze the financial feasibility of an event project, determine the

product/service choices to be made, and estimate the potential success of the

endeavor based on the profit motives of the sponsoring organization. The two

typical tools are the break-even analysis and bottom-up analysis.

-

Break-even

analysis:

determines the point when the event project will break even (revenues equal

expenditures); often used to determine the fees each attendee must be

charged to break even (break-even price) or the number of attendees paying a

pre-determined fee required to break even (break-even units).

-

Bottom-up

analysis: the

sum total of the estimated costs of an event project is used to determine

the revenues required to fund the endeavor; often used to determine the cost

of a hosted event or to determine whether an event project is feasible and

worth developing based on the revenue-generating capabilities of the hosting

organization.

The draft budget should be

prepared in great detail and include the calculations used to arrive at the line

item estimates so the budget-to-actual performance can be compared efficiently

and the budget adjusted as needed based on any variances. This is easier when

done in a spreadsheet software program, which allows quick “what if”

calculations and modifications.

Previous event budgets, income

statements, and cash flow statements are typically used to prepare a draft

budget, but if no historical records exist, a

zero-based budget (starting from “zero”) should be drafted using cost

estimates and comparable budgets from other events.

When the event is required to

break even or make a profit, you must make reasonable predictions of income

expectations and prepare cost-cutting strategies should the budgeted revenues

fall below expectations. Once the budget has been prepared, acquire approval or

consensus from the proper financial authority governing the event project

(client, host, financial officer, board, committee, management, etc.).

Forecast costs and revenues

Preparing a budget involves

visualizing the entire event in financial terms; identifying all potential

sources of income and expenditures. These are then organized into functional

groups, typically according to the categories specified in the chart of accounts

(or by each aspect of the event itself such as registration, exhibit, social

functions, etc.). These categories vary depending on the type and scope of the

event.

Typical revenue and expense categories

|

Community Festival |

Association Conference |

Hosted Reception |

|

Revenues

Ticket sales

Sponsorship sales

Concession fees

Advertising sales

Merchandise sales

Expenses

G&A

Advertising and

promotions

Grounds and

infrastructure

Operations

Entertainment

Merchandise

Hospitality

Risk management

Contingency |

Revenues

Registration fees

Sponsorships and

donations

Hotel commissions

Audiotape sales

Expenses

G&A

Printing and postage

Housing and space

rental

Audiovisual

Speaker costs

Food and beverage

Temporary staffing

Amenities

Contingency |

Revenues

Host investment

Expenses

Coordination fee (G&A)

Invitations

Venue rental

Transportation

Décor

Food and beverage

Entertainment

Technical production

Contingency |

Cost estimates must be

comprehensive, identifying all the potential expenditures that must be made

relative to the event project, including the contribution required to cover

overhead and other amortized costs as well as the value of in-kind donations.

Revenue estimates must be conservative, particularly if there are no historical

records to indicate previous income or growth trends. Overly optimistic revenue

projections have caused the downfall of many event projects.

Identifying Expenses

Virtually everything included

in an event project and its operations have costs attached. There will be fixed

costs, variable costs, time costs, overhead costs, opportunity costs (the cost

to take advantage of an opportunity, extending credit, etc.), selling costs,

collection costs (discounts for early payment, pursuing past due accounts,

etc.), and potentially hidden costs. There are varying levels of quality and

product/service solutions to achieve the goals and objectives of an event

project, and the budget is where these priorities and choices will likely be

made.

Fixed and variable expenses are

established in accordance with the size, type, and scope of the event project

and the prioritized needs of each component as well as its audience. Fixed

expenses are those that will likely not change if there are 200 or 250 guests or

attendees, such as the venue rental or a speaker’s fee. Other fixed costs

include operating costs or overhead – the indirect costs that must be covered by

the income, or a portion thereof, generated by the event.

Variable expenses are those

that will fluctuate depending on the attendance volume (such as food and

beverage, motor coaches for transfers, chair covers and linens, etc.), which

might include some typically fixed costs if the attendance goes beyond a certain

point (for example, renting a larger space or hiring additional personnel).

Event project updates must be scanned regularly to integrate budget updates in

response to scope changes.

Even the costs of servicing a

sponsorship must be included on the expense side of the budget, including the

per-person variable expenses of those given complimentary or reduced-fee

registrations or tickets (e.g., speakers, committee or board members, officials,

etc.). In addition, the value of an in-kind donation should be included on the

expense side of the budget in order to calculate the costs should that donation

not be secured, as well as commissions received (such as hotel commissions on

rooms booked) that will go to reducing the final bill must be listed as both

income and expenses – what the final bill would have been, to accurately reflect

the true bottom line of revenues over expenditures.

You must also incorporate the

cost of time into many calculations, from calculating your hours that are

billable to this event project, to evaluating the cost-effectiveness of

outsourcing, to controlling the schedule to avoid last minute or rush order

charges. Also consider hidden or unexpected expenses, such as those shown below.

Collect comprehensive estimates and carefully compare costs; anticipate ALL the

costs associated with the event project; and financially plan for surprises with

a line item for contingencies (typically 1 to 2 percent of the entire expense

budget).

Typical hidden or unanticipated costs

|

Cleaning fees

Commissions

Comps and perquisites

Connection charges

Delivery charges

Import or export duty

Gratuities

Installation charges

Last minute changes

Late charges and other

penalties

Maintenance fees

Meals for personnel

Mileage reimbursements |

On-site technicians

Overtime labor charges

Parking fees and tolls

Resort fees

Room set-up charges

Service charges

Shipping and handling

fees

Shuttle transfers

Sponsorship benefits

Taxes

Unexpected site

preparation costs

Unforeseen equipment

rentals

Usage surcharges

(facility or utility) |

Identifying Revenues

Identifying and forecasting

revenue is often more difficult than for costs, especially for new or one-time

events. You must carefully control the stability and success of the event’s

typical revenue sources as well as find numerous creative opportunities for

possible revenue streams, many of which are untapped or under-tapped.

Revenues can come into an event

organization through many different portals, not simply at the ticket window or

registration desk. From program advertising and souvenir merchandise sales at

sports events, to contest entry fees and special event ticket sales for awards

programs, to hotel commissions and session audiotape sales at conferences, there

are countless ways to generate revenues for an event.

Potential

event revenues

|

Advertising sales

Auctions and drawings

Cancellation or late

fees

Commissions

Contests

Entry fees

Exhibit space rental

fees |

Food and beverage

concessions

Grants and donations

In-kind sponsorships

Interest on deposits

Licensing fees

Merchandise sales

Parking fees |

Premium service passes

Rebates

Registration fees

Ticket sales

Special attractions

Special functions

Sponsorship sales |

Encourage event customers to

spend even more money. For example, the order form for tickets to the awards

banquet and logo wear merchandise might be included in the registration form for

a sailing regatta, or a multi-day entry pass or preferred parking area passes

(and even the opportunity to pre-purchase performers’ tapes) might be offered at

a music festival.

Also consider the

profit margin (the ratio of profit) that

different event elements contribute to the event revenues, as well as which of

these contribute the most to the bottom line. If the luncheon program at the

annual conference returns a better profit margin than the final night gala,

promote the ticket sales for that function at least as prominently as you do for

the gala tickets. If the food concessions provide a healthy profit margin at the

sport event, promote them heavily during the event. Know where the best profit

margins are generated and promote them (and replicate them).

Avoid the “we’ve always done it

this way” syndrome; instead, conduct creative brainstorming sessions to uncover

new and improved revenue streams for products, services and event features that

could provide much needed income for the event organization.

Allocate financial resources according to priorities

The event organizer is

responsible for the direction, allocation, and control of the resources

surrounding an event project through a sound business plan. A significant part

of that plan is the allocation of financial resources based on priority and

necessity. Sound financial management practices must be employed to ensure these

monetary resources are used effectively.

Priorities are based on the

goals and objectives of the event established by the host or hosting

organization, as well as the practical and regulatory requirements associated

with the event’s production. These priorities include needs, must-haves, wants,

and nice-to-haves. Needs are those budget items required for the event to take

place and the must-haves are those items that ensure the objectives of the event

can be achieved. The wants and nice-to-haves are those budget items that will

enhance the event experience or please certain stakeholders.

There is no such thing as an

“unlimited” budget. Financial resources are always finite. You must know the

priorities associated with the integrity of the event project, especially when

cost-cutting decisions must be made. First include the needs and must-haves in

the budget, which are the first priority, then incorporate the wants, and

finally the nice-to-haves. When budget cuts must be made the nice-to-haves will

be eliminated first, followed by the wants.

Track budget performance

No matter the type of profit

philosophy – profit, break-even, or hosted – you must analyze and track the

income and costs of an event project carefully. Review revenues and expenses

regularly, including monthly, weekly, and even daily depending on the scope of

the event project or the intensity of the financial activity. By comparing the

actual budget performance to its projected performance, it will be possible to

respond to variances by making adjustments and taking corrective actions as

necessary.

Integrate the budget into the

timeline to ensure financial decisions can be made in a timely and

cost-effective manner. A budget is a flexible document that should include

pre-determined cost-cutting methods, which will be guided by the prioritized

goals and objectives, with the critical decision points identified within the

timeline.

·

If you don’t have

sufficient attendance, do you move the reception from the off-premise location

back into the hotel?

·

If you don’t sell

a specific sponsorship package, do you eliminate that event element or do you

scale it back?

·

At what point do

you decide to send out another conference registration brochure to potential

attendees?

·

At what point do

you decide to cancel the elaborate centerpieces? The golf tournament? The

pyrotechnics?

·

At what point do

you decide that the event is simply not going to generate the revenues required

and you must cancel the whole thing? In the worst-case scenario, losing a little

money is better than losing a lot of money.

From the headline entertainment

act to the humble postage stamp there are hundreds and thousands of large and

small expenditures to keep track of and control. The more comprehensive the

budget worksheets and calculations, the more likely you will be able to contain

and cut costs in a manner that will still achieve the goals and objectives of an

event project.

Pricing

Price is always part of the

decision-making process. What you charge and they must pay (or what they charge

and what you must pay) factors into the purchase decision for both the buyer and

seller. From setting registration fees or ticket prices to preparing bid

quotations and negotiating rates, establishing the best price depends on fully

understanding the costs, profit requirements, and market value for any purchase

– yours and your customer’s.

Determining the right price is

not always a clear cut endeavor. It isn’t quite as simple as costs + profit =

price, although that certainly is the foundation because if there are

insufficient profits, the seller of the product or service (or event) will no

longer be in business and the product, service, or event will no longer be

available. And events are a business! Proper pricing is a fundamental component

of the financial success of that business.

How do you know if you have the

right price? The simple answer is: if the buyer is willing to buy at that price

and the seller is able to make money selling at that price. Buyers typically

want the lowest price possible and sellers want the highest price possible; the

balance rests on meeting the needs of each. Uncovering these requirements can

include some creative detective work and almost always involves careful

calculations.

However, knowing the numbers –

ALL the numbers – will help you determine the fair value of the products and

services the event project will purchase and those it has to sell. These numbers

are located throughout the event project’s administration, design, marketing,

operations, and risk management, with many reflected in the event project’s

budget.

Calculate direct and indirect costs

Calculating the costs that must

be factored into pricing includes determining the direct costs – those expenses

that are directly related to the event project or its individual components, and

the indirect costs – those expenses that are tangential to the event project and

support the overall operating needs of the event business.

Direct costs will include all

the goods and services that must be purchased for the event project, known as

the cost of goods, as well as the costs directly related to selling the products

and services of the event project, known as cost of sales. It is important to

identify which costs are fixed expenses that don't vary according to amounts)

and which are variable (expenses that do vary with the number of attendees,

amount of service provided or volume of goods produced).

Example of typical

fixed and variable direct costs for an association convention

|

Fixed |

Variable |

|

Audiovisual equipment

and personnel

Awards

Communications

equipment

Decorations

Entertainment

Insurance

Licensing fees

Office equipment and

supplies

Photographer

Postage

Promotional materials

Registration equipment

and personnel

Meeting room rentals

Security

Shipping

Signs

Staff travel and

lodging

Storage |

Badges and ribbons

Conference program

books

Food and beverage

Gifts and amenities

Gratuities

Labor

Speaker fees, travel

and lodging

Taxes

Temporary staffing

Note: some fixed cost

categories might become variable should attendance volume exceed a

certain level. |

Indirect costs will include all

the goods and services needed for the general administrative operations of the

event organization, known as overhead. Overhead should be amortized over the

duration of the event organization’s operations, usually a monthly contribution

disbursed within an annual cycle, as well as the amortized contribution costs of

any capital or long-term expenditures or reserves, such as for equipment

purchase or replacement.

For example, an association

might hold its annual convention as just one of many different activities, and a

portion of the overall operating budget, including the staff and other

resources, must be charged against the profits of that convention. Or an

independent event organizer or production firm will produce dozens of event

projects for different clients throughout the year, and the operating costs of

the business must be amortized over all these pieces of business. The ratio or

proportion of the operating budget or overhead that must be charged to a

specific event project will depend on the number of events or impact of the

event on the organization’s other activities and resources.

When you add the indirect costs

to direct costs, the total costs of the event project emerge, which will be the

basis for determining pricing once the profit requirements have been

established. However, don’t forget to seek out the hidden costs that can

potentially destroy any and all profit margins. Make absolutely certain the bids

you get, and those you offer, include ALL the charges.

Also pay attention to the

penalties and liabilities associated with change. Per-unit prices could go up if

numbers decrease (or if the numbers don’t increase enough to amortize increased

costs, e.g., too many people for three busses but not enough to fill four

busses), fees might be charged if guaranteed minimums are not met (e.g.,

attrition charges), or there could be costs

for accommodating changes after certain deadlines.

Determine profit requirements

Event organizations, event

production businesses, and the businesses that provide the goods and services to

events must make a profit to stay in business. What is critical for both event

projects and event businesses is the definition of profit expectations – the

amount or level of profit required, which is unique to each enterprise and based

on its short- and long-term goals and its responsibilities to its shareholders

or stakeholders.

Event projects have one of

three possible profit motives: to make a profit, to break even, or to operate at

a deficit as a hosted event. Typically social events (e.g., weddings and

reunions) and many corporate events (e.g., training programs and retail events)

are hosted events that do not expect a direct financial return, although the

return might be measured indirectly. Many conferences or recreation events have

break-even expectations, with the revenues covering all the expenses incurred.

Most other events have an expectation of revenues exceeding expenses. In some

organizations these profits are referred to as retained earnings, but the bottom

line objective is the same – money left over.

Profit requirements might be

expressed as specific dollar amounts or as a percentage, known as a profit

margin, which is calculated by dividing the net revenue (after expenses have

been deducted) by the total revenue (before expenses have been deducted). Profit

margins are often used to establish the mark-up that will be added by sellers

when preparing price quotations. Profit margins, however, do not necessarily

need to be consistently applied to all aspects of the event or the products and

services sold. You can make a little money on certain items or areas, break even

on others, even lose a little money on some, and sometimes make a lot of money

on others, and still achieve the bottom line requirements.

Establish pricing structure

Setting prices is a combination

of mathematics and marketing. You must know the costs, profit needs, and the

customer’s perception of value. Competition and the ratio of supply and demand

will influence what can be charged. Profit margins can be adjusted and discounts

might be offered based on the volumes sold. The financial demographics of the

target market can limit or increase price points.

Pricing is typically either

cost-based or value-based. Cost-based pricing uses a simple formula of

cost plus (e.g., time plus materials, cost

plus service fee, or cost plus profit margin mark-up). Value-based pricing adds

what the product or service being sold is worth to the buyer into the equation,

which might include such value perceptions as quality, convenience, mystique,

exclusivity, prestige, or other subjective judgments. Value-based pricing also

considers what the sale is worth to the seller and could indicate charging lower

prices to capture a new market, increase market share, improve seasonal cash

flow, or cultivate strategic business benefits.

Many events offer different

price points for different classes of attendees or purchase deadlines (members,

non-members, accompanying persons, early registration discounts, etc.) that are

designed to sculpt purchase behavior and/or encourage additional investment

(such as paying the membership dues to get the member price). Other events offer

higher-priced premium benefits or services such as exclusive parking, seating,

and lounge areas, or special access to certain participants, performers, and

hospitality functions.

Any pricing strategy, however,

relies on first calculating the break-even point – the point where revenues

equals expenses. This can be used to determine a break-even price or the

break-even number of units. To illustrate this, as shown below, assume the total

fixed costs (indirect and direct costs) for a recreation event equals $55,000

and the variable costs add up to $150 per person. In each case, there are

assumptions made about either the number of attendees expected or the

pre-determined price to be paid. In one case the per-person registration fee is

higher than the other, but that registration fee can be lowered if more

attendees could reasonably be projected. You must recognize the impact of the

price ceiling – the maximum tolerable price the attendee is willing to pay.

Break-even calculations

|

Break-Even Price

Registration Fee |

Break-Even Unit Volume

Number of Attendees |

|

Formula:

Multiply the variable

costs by the number of attendees and add the total fixed costs and total

variable costs, and then divide the total costs by the number of

attendees. |

Formula:

Subtract the per person

variable cost from the registration fee to get the contribution margin,

and then divide the total fixed costs by the contribution margin. |

|

Assumption: 250

attendees expected

Total Fixed

Costs $ 55,000

+ Variable

Costs $ 37,500 (250 X $150)

Total

Costs $ 92,500

92,500

= 370

250

$370 Registration Fee

needed to break even

250 X $370 = $92,500

Total Revenues

|

Assumption: $350

registration fee

Registration

Fee $ 350

– Per person Variable

Cost $ 150

Contribution

Margin $ 200

55,000

= 275

200

275 Attendees needed to

break even

275 X $350 =

$96,250 Total Revenues

– 275 X $150

$41,250 Total Var. Costs

$55,000 Total Fixed Costs |

When a specific profit amount

is required, this profit figure would be added to the total fixed costs.

Including such profit objectives in the expense side of a budget helps keep this

requirement in the forefront of the financial planning and pricing process.

When pricing services, such as

organizing events, the typical pricing strategies are a consulting fee, a

percentage of the expense budget, or a hybrid of the two. Here, again, there are

direct and indirect costs and profit margins that must be included. Determining

hourly rates follows the same break-even calculation procedure illustrated for

the recreation event registration fees. The per-hour price can be based on the

number of hours available; the income required divided by number of hours

available determines the per-hour price.

-

Consulting fees

can be determined on an hourly fee (billable hours) or a flat fee (determined

based on the estimated number of hours required for the scope of the project).

-

Percentage fees,

similar to cost plus, is a service fee (a specific percentage of the expense

budget) for handling the arrangements for the goods and services purchased.

-

Hybrid fees

incorporate elements of hourly and percentage pricing, recognizing that a

certain level of service is fundamental and as the scope of the goods and

services purchased increases, so does the complexity of service required.

When pricing products to be

sold or hired out to events, careful attention must be paid to calculating the

company’s cost of goods and overhead when determining mark-ups. For example, if

a décor company owns a scenic prop that it regularly rents out to event

projects, there is the cost to build it (time and materials) that must be

amortized over the life of its usefulness; the costs for keeping it in good

repair (supplies and labor); the costs for the space in which it is stored (rent

and utilities); and money that must be set aside to replace it when it’s no

longer suitable to hire out.

These costs are in addition to

the labor used to load, unload, move in, install, move out, load, unload, and

restock the prop back into its storage place, plus the costs of the truck and

fuel to move it to the event site and back again (and the truck’s maintenance,

etc.). There are also the general costs of being in business – rent, utilities,

payroll, equipment, etc. – that need to be incorporated into its price.

Cash Management

The monies that make the event

project possible are like the blood circulating through a healthy body; they

must flow properly for life to be sustainable. The proper circulation of cash

through the event project’s system depends on good contracting, sound purchasing

practices, and other cost controls that ensure the way in which money flows in

to and out of the system will meet its financial needs.

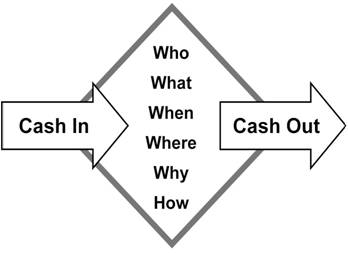

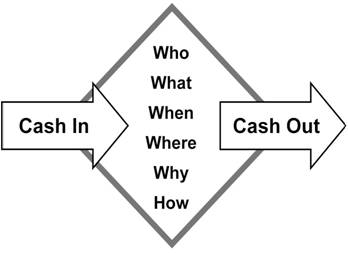

As shown below money (cash)

comes in and goes out from and to various people for various things, at various

times, at various locations, for various reasons, and in various forms. This

flow of cash is, and must be, managed in a way that benefits the event project

and event organization. You must understand all these in and out variables so

that you can establish effective cost controls and handling procedures that

ensure this money is collected, protected, and disbursed properly.

The facets of cash flow

Establish payment policies and procedures

It is vital that policies and

procedures to ensure strong internal financial controls are developed and

implemented. These should include who is authorized to make expenditures, what

will and will not be paid for by the event organization, when and how payments

will be made, where financial transactions will be handled, and why these

controls are necessary.

Execute written contracts with

all clients and vendors that clearly stipulate the financial obligations

incurred and the specifications affecting those obligations. Such obligations

can include payment schedules, guaranteed numbers or amounts, cancellation and

attrition penalties or formulas, and the authorization sequence and

documentation procedures prior to and during the event for such things as change

orders, scope increases, or other financial transactions.

Determine exactly who has

authority to authorize expenditures and carefully control those who do, making

certain unauthorized persons do not purchase items or sign contracts that

financially obligate the event project. Purchasing practices such as purchase

orders, invoicing procedures, expense reimbursement procedures, and committee

spending limits should be clearly defined and communicated. It is advisable to

always require invoices, purchase orders, or receipts before approving charges

or payments.

Develop procedures and criteria

for establishing or extending credit, setting up a

master account with the facility at which the event will be held, and

refund or billing dispute policies. Establish the banking procedures according

to the financial institutions where banking business will be done, such as

setting up a local bank account when organizing an event project in another city

to facilitate on-site income deposits and payments. It might be necessary or

advantageous to establish an escrow account into which the funds collected or

deposits paid are placed until they are authorized for use for a specific event.

Define and communicate master

account billing instructions. Limit what you will and will not be held

accountable for by specifying what charges may be posted to the account and the

names of people authorized to sign for expense items. Check the master account

periodically, preferably daily, and dispute any charges that have not been

authorized. Sub-master accounts might be included so that vendors can have their

charges paid by the facility and the amount paid out added to the master

account, but the same restrictions on who can order things must be clearly

defined.

Develop cost controls

In the modern event world

budgets are tight and event organizers are expected to do more with less; they

are held accountable for delivering sufficient returns on the investment in an

event project; and these trends are very likely to continue. There are only two

ways to improve a bottom line: sell more or cut costs. Cost cutting should begin

with cost control strategies such as those shown below.

Cost management and control

strategies

Every event element included in

the event project will have a cost and practically every event element will have

options at varying levels of quality and price offered by potential vendors.

The objective is to select the best products and services available to meet the

event goals and objectives within the budget allowed.

Seek bids or proposals from the

various vendors available for each product or service needed so you can compare

and evaluate which products and services will best meet the event needs at the

best price. To ensure the bids are comparable and complete, identify all the bid

specifications including the date, quantity, quality, dimensions, features,

brand names, or anything else important and critical to the success of the

event, plus any restrictions imposed on either the products and services sought

or the selection process itself.

Continually seek ways to

minimize costs, standardize operations, and economize whenever possible. Avoid

unnecessary costs such as overtime and penalties or fines by scheduling your

operations appropriately. Avoid waste by finding more cost-effective options,

such as limiting speakers at your training conference to a specific menu of

audiovisual options and scheduling sessions carefully so you can rent the AV

equipment by the week instead of by day or by room.

Take advantage of the economies

of scale as they apply to your purchasing practices. For example, by ordering

printed materials all at the same time it might be possible to combine all the

printing jobs for a celebrity sports clinic together as one. By having materials

printed at the location of an offshore event, you might be able to save on both

shipping and printing costs. It is the first printed page that is the most

expensive; almost all the rest are paper and ink only, so order sufficient

quantities of printed materials to avoid the higher costs of reprints.

Control the costs associated

with giving or getting “freebies,” those goods or services that are

theoretically “free” (but never truly are). You must carefully control the

distribution or issuance of complimentary (or reduced-fee) passes, admissions,

or registrations (known as comps). While

these might seem to be free, there are numerous variable costs associated with

them, as well as the reduction of income that results from their issuance.

This is often a problem with

association or corporate events where the leadership feels entitled to make

decisions about extending benefits to certain members, personnel, or vendors.

Get specific guidance regarding comps and perquisites from the event host or

sponsor and enlist their assistance in communicating and enforcing such

policies. Carefully monitor committee spending limits and entitlements as well.

You must know and use your

numbers when negotiating contracts and tracking the performance of your budget.

Know your attendance figures so you can accurately specify minimum and maximum

guarantees. If the figures show only 78 percent of attendees typically attend a

luncheon, only guarantee that 78 percent of the total attendance. Know the value

of your business to suppliers so you can negotiate the most favorable terms.

Count attendance; verify ticket sales or the banquet checks after each meal

function to avoid billing errors; and make adjustments as needed.

Track trends that will

influence purchase decisions and negotiations as well. For example, it might be

possible to use the overall revenues generated by your attendees, including

their hotel outlet usage (restaurant, bars, spa services, and mini-bar

consumption), using the total profit picture rather than just the profits on the

space-specific functions when negotiating hotel space rental rates. If your

group typically waits until the last minute to register for your event, factor

that into your negotiations on room block deadlines and cash flow projections.

Manage cash flow

In order to monitor and

maintain adequate cash to meet the organization’s disbursement needs, accurate

cash flow forecasting and management is necessary. Use the historical cash flow

statements to prepare a cash flow or time-phased budget that integrates revenue

and expense forecasts with cash flow to dictate where and when income is

expected and disbursements must be made to ensure sufficient financial resources

are on hand to cover the financial obligations. In lieu of historical records,

you would integrate the cost estimates and event schedule to arrive at a

spending plan.

Devise an accounts payable and

receivable system that ensures the timely and aggressive collection of

receivables and an advantageous bill payment schedule. The cash flow budget will

allow you to structure your deposit schedules, registration deadlines, accounts

payable due dates, and other revenue and expense transactions to your best

advantage.

The analysis of cash flow might

also affect pricing for you and your vendors, dictating such things as low,

shoulder, and peak season pricing and incentives to encourage prompt payment

(e.g., 2/10—net 30: two percent discount if paid within ten days, the entire

amount due within 30 days). Always remember that there is a time value to money.

Implement cash handling procedures

A critical component of

financial and budget control is the establishment of cash handling procedures to

protect the cash assets of the event organization. This includes procedures for

income and disbursements before, during, and after an event. You must also be

familiar with the banking procedures for the event organization, including

deposits, withdrawals, loans, and credit policies.

Specify procedures for petty

cash funds and disbursements. Throughout the event project there will likely be

small expenses that do not warrant or cannot accommodate the issuance of a

purchase order or even the writing of a check, but these expenses must still be

recorded and included in the financial records. Writing and cashing a check for

a small amount (typically $20 to $50) creates a petty cash fund, which is kept

separate from all other monies. When money is withdrawn for a small purchase or

payment, a voucher or receipt is placed in the petty cash box or envelope. These

vouchers or receipts should have the account code or line item name written on

them so they can be allocated properly in the bookkeeping records.

Establish on-site cash handling

procedures for any event where cash transactions take place – such as ticket

sales, registration payments or souvenir sales, to eliminate or mitigate the

possibilities of error, theft, or loss. These procedures will encompass

collections, change-making needs, secure transport and storage of cash,

reconciling cash counts, preparing point of sale reports, processing smart card

and credit card transactions, and making bank deposits. The type and extent of

your cash handling procedures will depend on the size and scope of the event and

the volume of transactions expected.

-

Set up a secure office or

area with a lockable safe to serve as an on-site bank or treasury.

-

Determine the amounts and

currency denominations for starting cash drawers for making change, and

establish the issuance and closeout protocols for these cash drawers.

-

Recruit or retain the

services of cash handlers, cash collectors, armed guards, cash counters, and

transport drivers as needed, and make certain anyone that handles money

on-site is bonded.

-

Schedule the periodic cash

collection and cash drawer culling from cash collection points based on the

volume of cash expected, and establish the counting procedure to ensure the

amounts are recorded by location.

-

Establish internal and

external auditing procedures with checks and balances for ticket sales

(e.g., sales records, unsold tickets, and cash deposit receipts), souvenir

sales, and on-site cash collections and counts.

Financial Reporting

Financial reports are critical

to ensuring the financial information you have is properly recorded,

interpreted, and distributed to the appropriate people. These reports are often

regulatory requirements, but can also be used for monitoring status and

measuring success, and they provide the starting point for your next budget

development task. They contain the data that will facilitate good decision

making and they should reflect the lessons learned so that this knowledge is

transferred to the next event project.

The financial information in

your reports can reveal where you can or should economize or dictate where you

need to become more efficient. This data can expose opportunities that can and

should be exploited, or activities that are no longer worthwhile. It can show

where and when operational tactics should be revised, such as changing the

deadlines for registration for better cash flow or modifying the advertising

plan – more, less, or different timing.

Financial information is

derived from and reflects the entire scope of the event project, and has

implications that could impact the entire scope of the event project. The

reports created using this information should not only fulfill standard record

keeping and accounting practice requirements; they should illustrate how and why

financial choices were made, and their results, in clear and compelling ways so

that stakeholders (and stockholders) understand the full nature of the event

project’s financial performance.

Establish reporting system

Establish a reporting system

that provides clear, accurate, and complete reports for management personnel

(e.g., the client or the event organization’s board), event committees, staff,

and other stakeholders. Specify the types and timing of reports so that the

information is delivered according to the purpose of the report and the needs of

its recipients, and that ensures any decisions or actions based on these reports

can be made in a timely manner. Prepare reports that “tell your story” when that

story needs to be told.

It is important to understand

that not everyone needs to know everything about the financial activities of the

event project. Certain types of financial information are proprietary and

suitable for release only to owners or governing bodies, while other types of

information could and should be communicated widely. You might need to keep the

standard accounting reports such as the balance sheet and income and cash flow

statements exclusive to management personnel, but data from those reports might

be used to prepare reports for external publics to illustrate the success of the

event and/or its importance as an asset in their communities.

Ensure financial statements are

prepared according to regulatory compliance requirements. Work with your

financial institution and financial personnel such as bookkeepers, accountants,

and auditors to determine the customary and necessary financial statements

according to the type of event project, business, or organization. For example,

political campaigns and non-profit organizations often have specific income

reporting requirements.

Some event organizations will

have monthly or quarterly board meetings at which reports are given by the

treasurer that show the financial activity and a balance sheet for the period

between meetings. Some event production companies will need these and other

financial statements when applying for a line of credit to protect against cash

flow vulnerabilities. Some event projects need these financial statements to

show solvency to authorities when requesting permits to hold the event.

Integrate these financial

statement and report requirements into scheduling, spreadsheet, and bookkeeping

programs so that the financial information is easy to compile and incorporate

into reports in a variety of ways. And make certain those who are receiving

these reports are capable of interpreting them correctly, which might mean

providing education along with the information.

Interpret financial information

There is a lot of information

in financial statements that can assist an event organizer with strategic

planning, monitoring budget performance, and controlling costs. Three typical

financial statements include the balance sheet, income statement, and cash flow

statement. Each has its own specific function, but when combined and viewed as a

whole provide a powerful picture of financial conditions and financial

performance.

-

The balance sheet

shows a picture of financial condition or net worth “as of” a certain date. It

can show profitability or indicate problems that must be overcome. It indicates

where the financial assets are located and what the financial obligations

(liabilities) are.

-

The income

statement shows the net income at a certain date, and illustrates how income and

expenses were distributed over a specific period of time.

-

The cash flow

statement shows when cash came in, when it went out, and when cash reserves will

be needed to overcome negative cash flow.

Sample balance sheet

|

ASSETS |

|

|

|

Checking Account |

22,400 |

|

|

Money Market Account |

3,000 |

|

|

Treasury Bill

|

20,000 |

|

|

Prepaid Expenses |

5,600 |

|

|

Petty Cash |

100 |

|

|

Accounts Receivable |

5,900 |

|

|

Total Assets |

|

57,000 |

|

|

|

|

|

LIABILITIES

|

|

|

|

Accounts Payable |

25,100 |

|

|

Taxes Payable |

1,500 |

|

|

Total Liabilities |

|

26,600 |

|

|

|

|

|

EQUITY |

|

|

|

Total Fund Balance |

30,400 |

|

|

Total Equity |

|

30,400 |

|

|

|

|

|

Total Liabilities & Equity |

|

57,000 |

Sample income statement from a

small festival

|

Period Ending November 30 |

Actual

Year-to-Date |

Budget

Year-to-Date |

|

INCOME |

|

|

|

Ticket Sales |

6,200 |

7,000 |

|

Sponsorship Sales |

15,000 |

20,000 |

|

Concession Fees |

2,500 |

3,000 |

|

Advertising Sales |

8,000 |

10,000 |

|

Merchandise Sales |

250 |

0 |

|

Contest Entries |

400 |

250 |

|

Total Income |

32,350 |

40,250 |

|

EXPENSES |

|

|

|

General & Administrative |

10,500 |

10,000 |

|

Advertising &

Promotions |

12,000 |

9,000 |

|

Grounds &

Infrastructure |

1,200 |

1,000 |

|

Operations |

3,500 |

3,000 |

|

Entertainment |

250 |

500 |

|

Merchandise |

6,350 |

6,000 |

|

Hospitality |

125 |

500 |

|

Risk Management |

150 |

400 |

|

Contingency |

650 |

300 |

|

Total Expenses |

34,725 |

30,700 |

|

|

|

|

|

Net Income (Loss) |

(2,375) |

9,550 |

Sample cash flow statement

|

|

J |

F |

M |

A |

M |

J |

J |

A |

S |

O |

N |

D |

|

Cash In |

0 |

0 |

100 |

200 |

300 |

400 |

500 |

1000 |

2000 |

3000 |

4000 |

5000 |

|

Cash Out |

500 |

500 |

400 |

300 |

200 |

300 |

400 |

500 |

600 |

1000 |

1000 |

1000 |

|

Net Cash Flow |

(500) |

(500) |

(300) |

(100) |

100 |

100 |

100 |

500 |

1400 |

2000 |

3000 |

4000 |

|

Cumulative Cash Flow |

(500) |

(1000) |

(1300) |

(1400) |

(1300) |

(1200) |

(1100) |

(600) |

800 |

2800 |

5800 |

9800 |

A great deal can be learned and

inferred from the balance sheet, income statement, and other financial reports

if you know how to interpret them properly. You can evaluate profitability and

the impact of economic and budget factors on financial planning, investment

policies, and financial performance. You can analyze percentage increases and

decreases and recommend strategies for improving financial performance. You can

conduct effective cost/benefit analyses to determine profit centers and warning

signs. You can forecast cash flow and monitor budget performance.

Using the sample income

statement from the small festival above, the figure shown below examines the

techniques for interpreting the report and the information it includes. Much of

the analysis depends on when this statement is issued within the event project

timeline and whether you are measuring or monitoring financial performance.

Interpreting an income

statement

Prepare financial reports

Financial reports need to

include the financial figures, but these need to be put into the proper context.

As illustrated with the sample income statement for the small festival, a single

financial statement does not tell the whole story. In addition, although these

standard accounting statements might need to be presented as columns of numbers

as a matter of form, they should be supported with plain language explanations,

conclusions, and recommendations. Numbers, percentages, and statistics should

illustrate a narrative.

Use graphics, percentages, and

comparisons to increase the impact and comprehension of the financial

information. Graphical depictions such as bar charts and pie charts show the

meaning of the raw data provided. Using percentages to express numbers helps to

show an accurate representation of what is happening or has happened. For

example, an increase of 200 participants could represent a 50% increase if last

year’s fun run had 400 participants, but only a 1% increase if last year’s

festival sold 20,000 tickets. Comparing the financial reports and budgets over

several years can reveal upward and downward trends that must be incorporated

into the organization’s financial planning.

Maintain financial records

It is important to maintain

financial records properly, including fastidious bookkeeping, to ensure

financial reports and statements are retained and accessible for tracking and

forecasting budget performance and making good financial decisions. This is a

legal and fiduciary responsibility. It is also important to have finances

independently reviewed and audited on a periodic basis to ensure that the

figures, and the decisions made based on them, are accurate and trustworthy, and

that they conform to standard accounting principles.

Some records must be kept for a

specific time for taxation requirements; others should be kept for research

purposes. You will determine what should be kept, and in what form, by

consulting with your financial professionals and advisors. As noted before, some

records (both physical and digital) contain proprietary information and must be

securely stored to prevent loss, tampering, or unauthorized release. Use

lockable storage equipment for physical records and password-protected systems

for electronic records. Back up electronic data on a regular basis and consider

back-up storage sites for physical files.

Summary

To review, this article

examined the standard accounting practices and terminology, which should prepare

you to work with the financial personnel responsible for maintaining the

accounting system. The importance of income and expense budgets and the tactics

for developing, adhering to, and monitoring them so that profit expectations can

be met were discussed. Pricing procedures were explored so that accurate and

appropriate prices can be established that will meet profit requirements for the

seller and provide value for the buyer. Strategies for managing cash flow were

considered, which should help you establish effective payment procedures and

cost controls, as well as manage how and when money circulates through the

financial system of an event project. Finally, the importance and obligations of

financial reports and the opportunities and options their contents can reveal

were reviewed, which should enable you to interpret and utilize financial

information to benefit the event project and event organization.

Financial management functions

will occur throughout the lifecycle of the event project and will be applicable

across all aspects of the event components and activities. The entirety of the

event project must be viewed in financial terms. Budgets must be developed based

on realistic and reasonable projections and monitored closely to ensure spending

limits are enforced and expectations are met. Calculating the resources and

costs to be included in the budget requires comprehensive and sometimes creative

detective work. Revenue streams must be identified and exploited to their

fullest potential and expenses must be carefully computed and closely tracked so

cost-cutting measures can be employed in a timely and fiscally responsible

manner. Remember: Nothing happens without money!

Terminology

-

account codes: the numerical

codes included in a chart of accounts

-

attrition: monetary penalties

if contractual usage guarantees underperform

-

bookkeeping: recording income

and expense transactions in the accounting system

-

bottom line: the final figure

in a financial statement that reflects either a profit or loss

-

bottom-up analysis: the

totaling of estimated costs to determine required revenues

-

break-even analysis: the

analysis of income and expenses to determine a break-even point

-

comps: complimentary or

reduced-fee items or entitlements

-

cost plus: a pricing strategy

based on the cost of an item or service

-

master account: a facility’s

account into which items ordered by a group are charged

-

profit margin: total revenues

less total expenses, often expressed in a percentage

-

underlying documents: documents

used to substantiate income and expense sources and authorizations

-

zero-based budget: a budget

developed without benefit of a previous year’s budget

See Also:

Accounting

/ Auditing

Budget

Development

Cost/Benefit

Analysis

Deposit Policies

Economic

Impact

Back to EMBOK Matrix

|